Malaysia Web3 Market Overview

From market map to outlook

TL;DR

Economic growth and industry diversification: Malaysia's economic growth has been driven by resources such as tin, palm oil, and petroleum, and various government policies have led to significant growth in services and manufacturing.

Access to blockchain and digital assets: The Malaysian government is working to increase public awareness of blockchain technology, and cryptocurrency ownership is quite high.

Prospects of the Web3 market: Despite the presence of global players and basic awareness of blockchain, the Web3 market in Malaysia is still in its infancy and will need to find its own color.

Malaysia, One of the five tigers of Asia

Malaysia is one of the "five tigers" of Asia, one of the five countries considered to be the economic giants of the future. In the past, Malaysia's growth was mainly based on its abundant resources such as tin, palm oil, and petroleum, but various government policies such as 'Vision 2020' have led to significant growth in the service industry and manufacturing industry. Currently, the service industry accounts for more than 50% of Malaysia's industrial structure, with the wholesale and retail, government services, and financial services sectors leading the growth of the service industry.

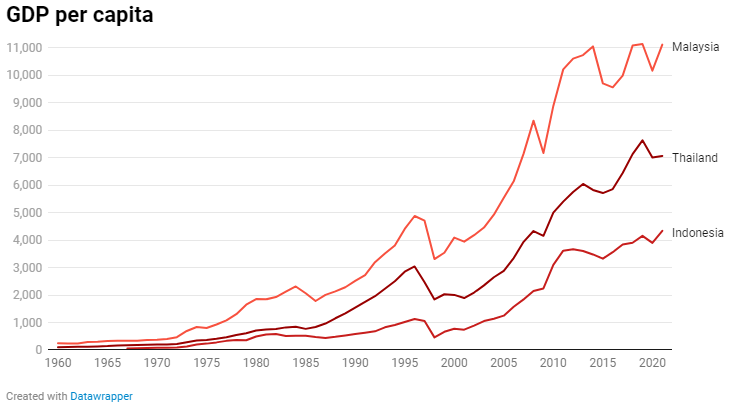

Malaysia's GDP per capita is higher than Thailand and Indonesia, and its population of about 33.56 million is smaller than Indonesia (273 million) and Vietnam (97 million). It also has a young population with a median age of 30.3 years, making it one of the most promising countries for future growth. There are a few things that set Malaysia apart from other Asian countries:

Government-led economic development: The Malaysian government sets the direction and budget for future economic development by setting up economic development plans in a five-year timeframe. Since the mid-1980s, the government has actively pursued policies to attract foreign investment, with particular emphasis on high-tech and high-value-added industries and knowledge-based services.

High income levels: Malaysia has one of the largest middle classes in Southeast Asia, along with Singapore and other countries. With a GDP per capita of more than $10,000 and a strong middle class, there is a growing demand for luxury brands and a high demand for high-end durable consumer goods such as home appliances and automobiles, as well as high-quality household goods.

Influence of overseas Chinese capital: Chinese Malaysians, who make up about 25% of the population, dominate nearly every sector of the domestic market, including finance, real estate, food, and retail.

Global Halal Hub: Malaysia has one of the most complete halal environments in the world, serving as a bridgehead for the halal market in various fields such as food, medicine, dietary supplements, and cosmetics. This is also having an impact on the blockchain market, with the emergence of the Halogen Shariah Bitcoin Fund, which complies with Shariah law.

Generalization of English: Although the official language is Malay, English education continues to be reinforced and English is generally widely spoken at all levels of society, making it easy to do business.

Current awareness of blockchain technology in Malaysia

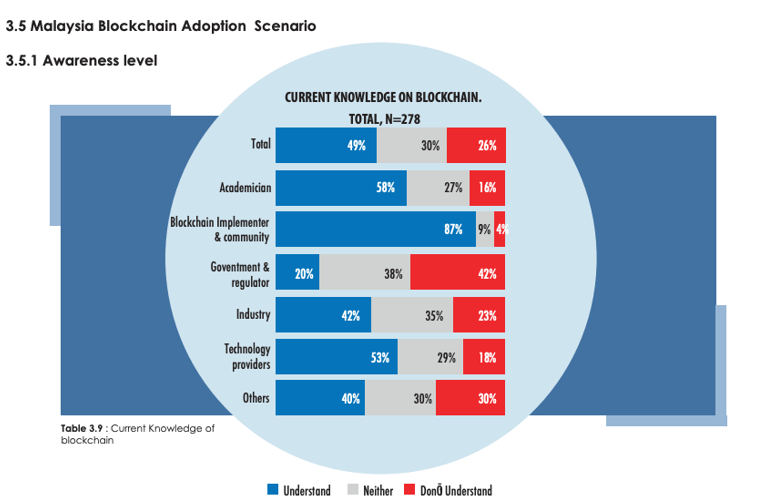

According to the recently released "National Blockchain Roadmap" by Malaysia's Ministry of Science, Technology and Innovation (MOSTI), the percentage of Malaysians who understand blockchain is around 49%. However, as with any business, there is a low level of awareness when it comes to legal and regulatory issues. Excluding this, we can see that a majority of the population, around 56%, has an understanding of blockchain.

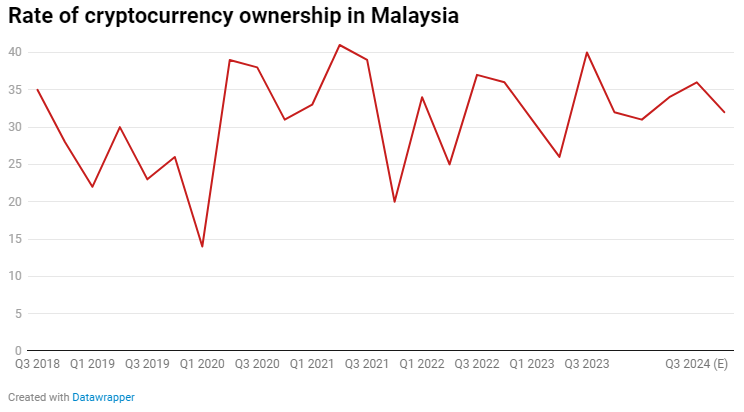

According to a report by the research firm Oppotus Research Group in Malaysia, 40% of Malaysians hold cryptocurrencies as of Q3 2023, though the number is likely to decline in 2024. (This seems to be due to a conservative approach as the global average is around 10%)

Key regulatory developments in the Web3 market

Currently, Malaysia, like most countries, recognizes cryptocurrencies as digital assets, but not as a currency or payment method. It has also formally registered and regulated cryptocurrency exchanges and is moving to utilize the technology. The current regulatory landscape seems to have the basic framework in place to enhance transparency and stability in crypto trading and protect investors. However, the Securities Commission Malaysia (SCM) and Bank Negara Malaysia (BNM) have yet to issue comprehensive regulations on cryptocurrency trading and investment activities, so it is important to keep an eye on the direction of regulation.

Legal Status

Cryptocurrencies are not considered legal tender in Malaysia

Malaysia's finance minister says crypto is not suitable for use as a payment method, but recognizes it as a store of value

Regulation of cryptocurrency exchanges

Cryptocurrency exchanges are regulated by the Securities Commission Malaysia (SCM)

Capital Markets and Services Regulation: Provides clear rules for the operation of exchanges. All exchanges must be registered by the SCM and comply with anti-money laundering and combating the financing of terrorism (AML/CFT) obligations

Digital Asset Guidelines: regulate behaviors such as issuing and custody of tokens

Authorized Market Guidelines: Introduces new requirements for digital asset exchanges, allowing four authorized market operators to do business in Malaysia

Classification and regulation of digital assets

In Malaysia, digital assets are primarily considered securities, which are regulated under the relevant laws.

The 2019 Digital Asset Guidelines regulate initial exchange publishing platforms and other related activities.

The 2019 Digital Asset Guidelines regulate initial exchange and listing platforms and other related activities.

The SCM sets out certain conditions under which digital assets can be considered securities

Tax policy

No tax on capital gains from cryptocurrency trading

Individuals who meet certain criteria, such as cryptocurrency trading volume, holdings, number of transactions, etc. must pay an income tax of 2~30% depending on their income level.

Two key documents from the government

1) Malaysia digital economy blueprint

Malaysia's Ministry of Economic Planning recently released a document called the Malaysia Digital Economy Blueprint. The blueprint serves as a roadmap to transform the country's industrial structure from one that is limited to services and manufacturing to one that is centered on digital technologies. It includes a comprehensive strategy for developing Malaysia's digital economy, from utilizing digital technologies to fostering talent. Notably, it outlines the policies, strategies, and action plans that the government intends to implement, and blockchain is mentioned within the document.

Industry 4.0 technologies: Blockchain is recognized as one of the key areas of Fourth Industrial Revolution technologies, along with cloud computing and big data. There is recognition that these technologies, including blockchain, are transforming many sectors and fueling the digital economy.

Healthcare: Describes plans to accelerate the Malaysian Health Data Warehouse (MyHDW) by adopting blockchain technology. The adoption of blockchain technology aims to improve healthcare service delivery through efficient policy-making and streamlined operations.

Streamlining government service delivery: Blockchain is also mentioned in the context of countering cyberattacks and streamlining medical records. To improve the efficiency of digital service delivery, the government aims to introduce the mandatory use of some digital technologies, including blockchain, and says it will achieve 80% of government service operations online by 2025.

2) National Blockchain Roadmap 2021-2025

The Ministry of Science, Technology and Innovation (MOSTI) recently launched the National Blockchain Roadmap 2021-2025 for Malaysia. The roadmap clearly outlines how Malaysia plans to strengthen its position by focusing on blockchain technology. However, the document is a project that started in 2020 and is far from current.

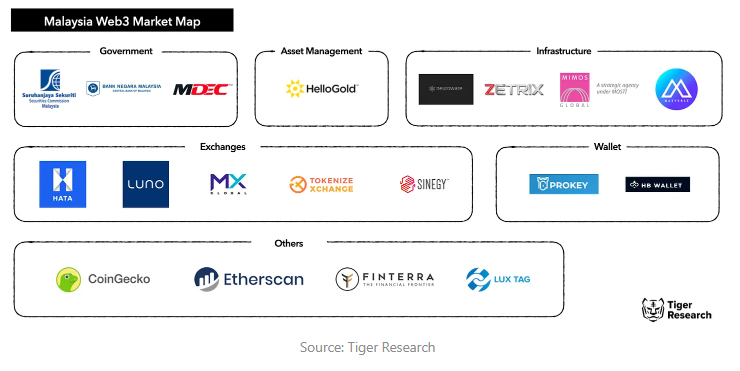

Key players

(Please note that the Malaysia Web3 market map above is based on publicly available data and may be subject to revision based on future visits to the country).

Many people think that Malaysia's Web3 projects are not very well known. However, as you can see from the market map above, there are many famous projects in Malaysia, such as CoinGecko and Etherscan. Also, as mentioned in our previous report, many Web3 projects are located in Kuala Lumpur, which is likely due to 1) its startup-friendly environment (ranked 11th in the global startup environment) and 2) its geographical advantage as an aviation hub in the Southeast Asian region. In fact, both CoinGecko and Etherscan are actively recruiting employees to work in Malaysia through Web3 Jobs, indicating significant in-country hiring.

As for government bodies, there is the Securities Commission Malaysia (SCM) and Bank Negara Malaysia (BNM), as well as the Malaysian Digital Economy Corporation (MDEC). MDEC is a government agency under the Ministry of Digital Affairs and was established in 1996 to lead Malaysia's digital economy. It has been identified as pushing blockchain-related activities.

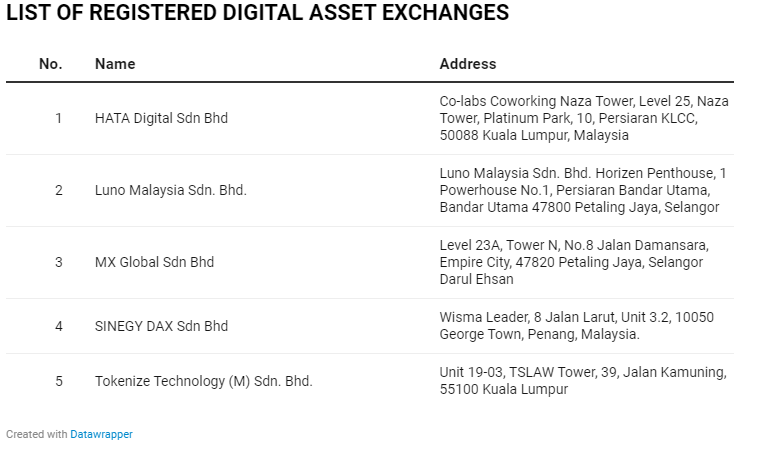

Various exchanges used to exist in the country, but only five remain after the implementation of regulations. According to Statista, Luno is the dominant exchange, and Malaysia is expected to be just as active in the use of global exchanges as other countries.

While there were no prominent DeFi or NFT projects, it's worth noting that there are local mainnet projects such as ZETRIX. ZETRIX is owned by MyEG Services Bhd which recently provided Chinese citizens with the technology to digitize their ID cards and driver's licenses on the blockchain for international travel.

Still a lot of time is needed

Among Asian countries, Malaysia's Web3 market is not one of the most prominent. However, the presence of global players such as CoinGecko and Etherscan proves that Malaysia is not a lost opportunity. It is worth keeping an eye on Malaysia, as such projects could be a vehicle for people to enter the blockchain market, similar to Vietnam's “Axie Infinity”. The country also has a solid foundation, with a large number of people owning cryptocurrencies and having a basic awareness of blockchain technology.

In addition, the country's basic economic situation is looking favorable. With a GDP per capita of more than $10,000, the country is not locked into depending on its natural resources and continues to explore new industries. Its recent GDP also grew by 8.7% in ‘23 compared to ‘22 and is comparable in size to Hong Kong and Singapore.

The government's proactive digital economy strategy and blockchain roadmap are also helping the Malaysian Web3 market to grow steadily. However, it is true that there is still a lack of regulatory clarity and incentives to enter the market similar to that of other Southeast Asian countries. Nevertheless, Malaysia's industry structure has gone through a significant transformation so far by the state-led roadmap, so there is room for optimism.

Even under favorable circumstances, Malaysia's Web3 market needs a lot of work. Despite the solid foundation and the presence of global projects, there is no distinct color of Malaysia. Vietnam has an abundance of blockchain developers. The Philippines has a large blockchain gaming population. Malaysia must find its own characteristics that can define its market.

DISCLAIMER & WARNING

The information provided here is presented "as is'' and is intended for general informational and educational purposes only. It does not come with any representation or warranty of any kind. This content should not be interpreted as financial, legal, or other professional advice, and it is not intended to endorse or recommend the purchase of any specific product or service. It is advisable to consult with appropriate professional advisors for personalised guidance. In cases where the article is contributed by a third-party author, please note that the expressed views belong to the author alone and may not necessarily reflect the opinions of Hata. For further details, we encourage you to read our complete disclaimer. Please be aware that the prices of digital assets can be highly volatile. The value of your investment may increase or decrease, and there is a risk that you may not recover the full amount invested. You are solely responsible for making your own investment decisions, and Hata cannot be held liable for any losses you may incur. This material is not to be construed as financial, legal, or other professional advice. For more information, please refer to Hata’s Terms of Use and Risk Warning.