Navigating Crypto Taxation in Malaysia: A Comprehensive Guide

The State of Crypto in Malaysia

The popularity of digital assets, or cryptocurrencies, is on the rise globally and notably in Malaysia, where ownership surpasses the global average at 20%. With an estimated RM21 billion in crypto assets, Malaysians are actively participating in the crypto market. However, the crucial question for investors remains: Is crypto taxable in Malaysia?

Understanding Crypto Taxation Laws

Crypto taxation in Malaysia is provided by the Inland Revenue Board of Malaysia (IRBM) or Lembaga Hasil Dalam Negeri Malaysia (LHDN). This perspective delves into several facets, such as the applicability of Malaysian income tax to cryptocurrency, adherence to the Income Tax Act of 1967, and specific considerations applicable to active cryptocurrency traders. Investors should navigate these regulations thoughtfully to ensure compliance and accurate reporting of their crypto-related financial activities.

Crypto: Taxable or Not?

LHDN's initial guideline indicated that crypto is taxable only if it is traded, distinguishing between trading and investment activities. As of August 26, 2022, a more detailed guideline has provided further clarity. Crypto is deemed taxable if it is involved in trading (continuous, systematic, active), business or mining activities, or if it is received as salary (deductible as business expenses).

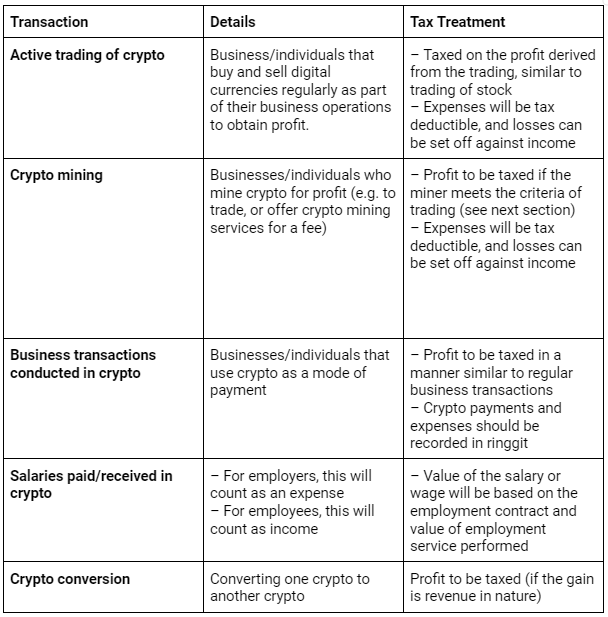

Below is a table that provides a great summary on taxable and non taxable crypto transactions, courtesy of RinggitPlus.

1. Taxable crypto transactions (business/trading transactions)

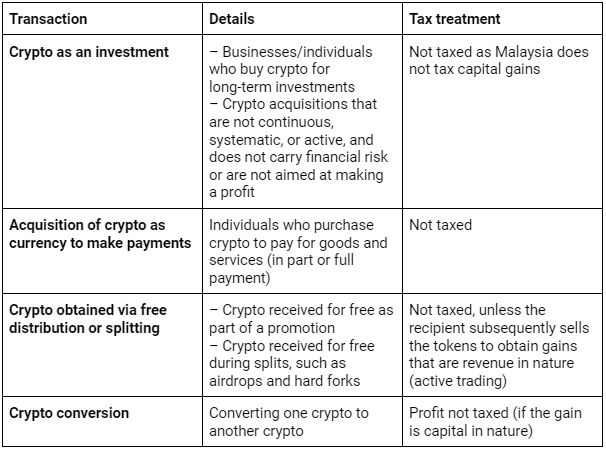

2) Non-taxable crypto transactions (non-business/trading transactions).

Tax-Free Crypto Transactions in Malaysia

Certain crypto transactions are considered tax-free, such as selling or spending crypto, swapping crypto, gifting crypto, airdrops and hard forks, crypto donations, buying and holding crypto, and transferring crypto between wallets.

What is Considered Trading?

In Malaysia, the classification of crypto activities as trading is determined by the Inland Revenue Board of Malaysia (LHDN) based on eight key considerations known as "badges of trade." These factors include dealing in large quantities, holding assets for a short duration, engaging in high-frequency transactions, making efforts to enhance marketability, and considering realization circumstances. For instance, selling crypto under urgent cash needs or the threat of foreclosure (for companies) is less likely to indicate trading.

Motivation is another crucial factor in the classification process, where an individual's intent in purchasing crypto, such as conducting business-like activities (e.g., developing business plans, advertising digital currency business), is taken into account. Additionally, the financing method plays a role, as purchasing crypto with short-term financing is considered a stronger indicator of trading than using long-term financing. Other relevant factors encompass conducting feasibility studies, the availability of documentation, and any other evidence indicating business or individual intent.

Crypto Valuation and Capital Gains Calculation

Assessing the appreciation or depreciation in cryptocurrency value and calculating capital gains involves examining the profits or losses incurred through the sale of digital assets. Investors must maintain precise transaction records, considering factors like the acquisition cost, holding period, and transaction fees.

In the context of cryptocurrency taxation in Malaysia, there is no specific capital gains tax in place. However, individuals actively trading in the crypto market may be obligated to pay income taxes, with rates varying from 3% to 30%, depending on their total income. It is crucial for cryptocurrency enthusiasts in Malaysia to stay informed about these aspects to ensure compliance with the relevant tax laws. To simplify tax computations, businesses or individuals are advised to document all cryptocurrency purchases and sales in Malaysian Ringgit, using market values. The first-in-first-out principle is utilized to determine the acquisition cost unless evidence supports an alternative approach.

How to Report Crypto Taxes in Malaysia

Taxpayers engaged in day trading or receiving salary revenue in cryptocurrency are required to submit their income tax returns by April 30. The e-Daftar web portal facilitates this process, ensuring compliance with reporting requirements.

Conclusion

As Malaysia's crypto landscape evolves, understanding the tax implications becomes crucial for investors and businesses. This guide aims to provide a comprehensive overview of LHDN's guidelines and the broader crypto tax framework in Malaysia, empowering individuals to navigate the complexities of crypto taxation effectively. As regulations continue to develop, staying informed and seeking professional advice are essential for ensuring compliance and minimizing tax liabilities in the dynamic world of cryptocurrency.

References:

Alex C.P.Y. (2023, April 13). Crypto Tax in Malaysia: What You Need To Know. RinggitPlus. Retrieved 30, January 2024, from https://ringgitplus.com/en/blog/income-tax/crypto-tax-in-malaysia-what-you-need-to-know.html

The information provided here is presented "as is'' and is intended for general informational and educational purposes only. It does not come with any representation or warranty of any kind. This content should not be interpreted as financial, legal, or other professional advice, and it is not intended to endorse or recommend the purchase of any specific product or service. It is advisable to consult with appropriate professional advisors for personalised guidance. In cases where the article is contributed by a third-party author, please note that the expressed views belong to the author alone and may not necessarily reflect the opinions of Hata. For furthedetails, we encourage you to read our complete disclaimer. Please be aware that the prices of digital assets can be highly volatile. The value of your investment may increase or decrease, and there is a risk that you may not recover the full amount invested. You are solely responsible for making your own investment decisions, and Hata cannot be held liable for any losses you may incur. This material is not to be construed as financial, legal, or other professional advice. For more information, please refer to Hata’s Terms of Use and Risk Warning.